Tax Forms

Select the applicable certificates(s) from the list of states below or use the Uniform [Code List] or Streamlined (Single state - insert 2 digit state code, multi-state fill out page 182C) Certificate for multiple states. The information in the form should be for your Ship To locations.

Email or fax the completed, signed certificates(s) to [email protected] or fax to (716) 849-6424. Please include your Graphic Controls account number (if known) on your fax or email.

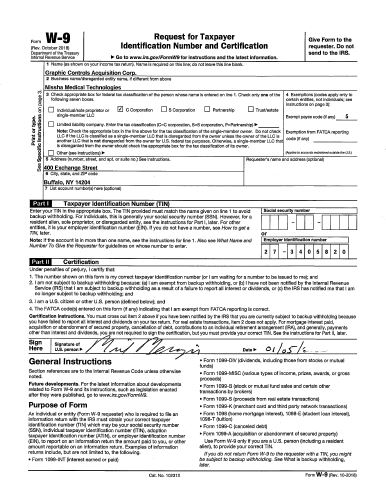

Please Note: Graphic Controls can only accept documents that are complete, signed and dated. Please do not send tax permits, licenses, registrations, or W9's. Exemption can not be established using these documents.

Non-Registered States

Graphic controls is currently NOT REGISTERED in the states of:

AL, CT, DC, HI, IA, ID, KS, KY, MD, ME, MN, MT, ND, NM, OK, RI, SC, SD, UT, VA, WY

No tax will be billed for these states. You must accrue and pay tax directly to the state.

- Issued Annual Resale Certificate

Good for 1 Year - Uniform Certificate

- Supply Resale Number

- Uniform Certificate

- Streamlined Certificate

- State Form: ST-3, ST-4

- Uniform Certificate

- Streamlined Certificate

- State Form: 5-3, 5-M

- Uniform Certificate